Bitcoin is the oldest, most famous, and most valuable cryptocurrency in the world. Also, it has the biggest market cap and is still the cryptocurrency market leader by a long shot.

This, combined with the fact that bitcoin is still expected to grow in value in the future, makes people wonder what’s the reason for bitcoin’s huge success. And the answer basically lies in the technology behind it that has introduced many radical innovations in the fields of computing and finance.

For many people, Bitcoin is still something too abstract, or simply too complex to grasp. This often raises many questions and suspicions. However, understanding the details of the banking system is also extremely difficult, so this isn’t really a good reason to be wary of the bitcoin network.

Of course, this doesn’t mean that finding ways to describe bitcoin and the underlying technology to the wider population won’t help people gain trust in it. Bitcoin offers a new, safer, and decentralized way of executing and validating financial transactions. So let’s start then.

History of bitcoin

Let’s first see how bitcoin emerged in the first place and how it evolved throughout its history.

The first bitcoin was released in 2009, based on the 2008 white paper written by Satoshi Nakamoto. Nakamoto is only an alias for a person or a group of people or an entire organization – the real identity of the bitcoin inventor has never been revealed.

Evolution of bitcoin

After the initial release, it took time until bitcoin picked up some steam. The first known commercial transaction took place in 2010 when a programmer bought two pizzas for 10,000 bitcoins, the number of coins that would probably buy him roughly 100,000,000 pizzas in 2021. At first used mostly by IT enthusiasts and tech geeks, it took some time until bitcoin became widely recognized as a viable payment option.

In February of 2011, bitcoin hit parity with the dollar for the first time, and already in July the same year, its price has surpassed 30 dollars, only to fall to 10% of that value in the next five months. These abrupt ups and downs have been characteristic of bitcoin to this day, but nevertheless, it has always managed to keep a steady growth over extended periods of time.

There have been several occasions of such wild behavior of bitcoin, most notably in 2013, 2017, and 2021. Every time it enters a bull market it undergoes a 10-fold increase in price, or sometimes even more. Bitcoin has peaked in November 2021 when it hit $67,000 and in March 2022 its price stands at around $40,000.

The (in)stability of bitcoin

The steady rise of bitcoin in the last 10 years is definitely due to the underlying blockchain technology exhibiting reliability and gaining more trust by the people. Over the years, bitcoin has time and again proved to be ultimately stable and trustworthy. Moreover, the utility of a distributed, secure, and predominantly anonymous payment system has caught the public’s attention.

Sometimes, there are external factors that affect its price, such as embracement by governments, politicians, entrepreneurs, or even celebrities. And there are also purely circumstantial factors that have nothing to do with bitcoin.

For instance, in 2020 and 2021 bitcoin grew from $6,000 to $67,000 mostly because of the pandemic breakout. In a lockdown world where a lot of us were stuck at our screens, communicating and working in the digital world with digital tools, it made sense that a digital currency would gain popularity.

How does bitcoin work?

If you open the hood of bitcoin, you’ll find a blockchain and huge machinery consisting of thousands of different devices generating new blocks, verifying them, and adding them to the blockchain. Now what does this even mean?

Blockchain technology

The first version of a blockchain-like protocol was proposed back in the 80s, but the first broad and far-reaching application of this technology was the development of bitcoin.

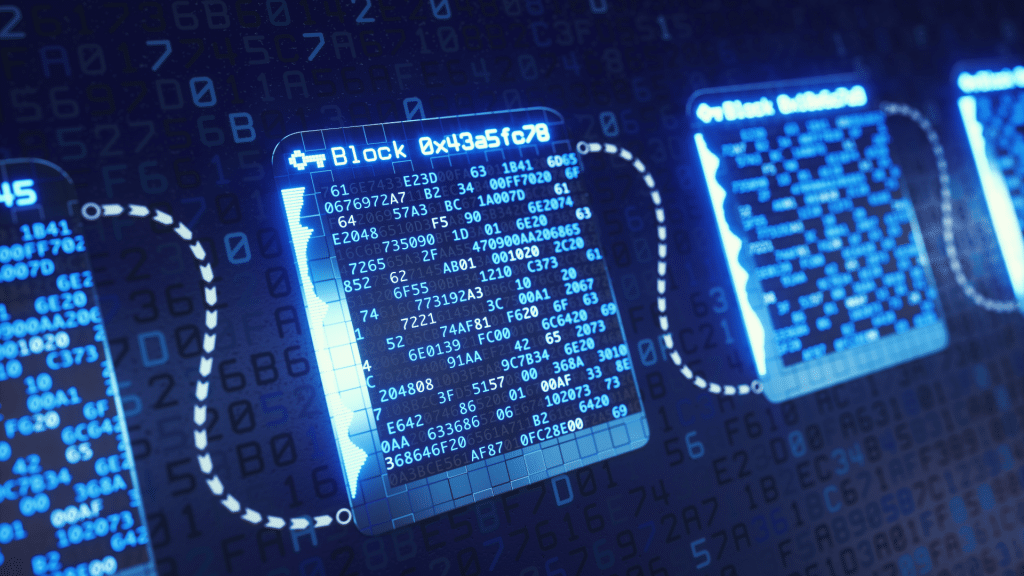

Blockchain is basically a digital ledger that records all the transactions that ever happened on a certain network. In this case, this network is the bitcoin blockchain and it contains every single bitcoin transaction ever made.

The catch with blockchain is that it’s a completely decentralized system. This means that processing transactions is not the job of a central bank or any other institution. In blockchains, this is done by thousands of nodes in the network, controlled by thousands of independent users. Transactions can be permanently recorded on the blockchain only if the nodes reach a consensus about their validity. In addition, every node in the system holds a copy of the whole ledger and updates it every time it changes.

Now, a block refers to a collection of the latest transactions arranged into bundles, or “blocks”. On the bitcoin blockchain, a block is produced roughly every 10 minutes and after it’s validated it gets added to the existing chain of blocks.

Validating transactions in a decentralized manner

What we still need to make clear, however, is who these validators are, how do they check the blocks and why do they even bother doing it? Let’s analyze that in more detail.

In short, validators get rewards for their job in the form of a certain number of bitcoins. Validators are not humans, but they are machines set up by humans. These devices are verifying whether the transactions have been executed according to certain procedures prescribed by the network.

Every node on the network collects a number of new and unprocessed transactions and arranges them into a block. Once it finishes compiling a block, it starts solving a difficult cryptographic problem, competing with all the other nodes. Only the first one to solve it gets the substantial bitcoin prize, while others continue to communicate, checking whether the “official” records are valid, and try to add new blocks if everything’s fine. It’s crucial to emphasize that solving the problem requires a whole lot of processing power.

Proof-of-work

A reasonable question now would be – why? Why do they even compete for the first place if they will all check the transactions anyway? Couldn’t you just randomly choose who to reward instead of wasting all that energy? Here we come to the heart of the bitcoin blockchain (and most other blockchains): the idea of the proof-of-work.

Proof-of-work functions as a protection against all kinds of cyber-attacks. To put it simply, in order to get a chance to validate payments and earn bitcoins, you have to show proof that you’ve spent quite an amount of energy in the process. And this is because of the nature of blockchains – you need to control 51% of all nodes on the blockchain in order to reach a consensus and manipulate the network as you wish.

But if you make all the validators spend huge amounts of energy while solving the cryptographic puzzle, this means that controlling 51% of the entire blockchain is tremendously expensive and virtually impossible for any single person or a small group of people. Controlling 51% of the bitcoin blockchain would require ridiculous amounts of energy and this fact makes it absurdly hard to hack it.

Bitcoin mining

Let’s move from the bigger picture and switch to the view of the individual validators, or “miners”. They are called miners because they don’t receive their bitcoins from an existing pool of crypto money, but they actually create new ones. So every time a block is produced, the total number of bitcoins increases.

There’s a limit to this number, pre-defined in the Bitcoin protocol. The current number of bitcoins in circulation is close to 19 million, and the network will start producing new ones once this number reaches 21 million. The network is carefully programmed so that this happens in 2140.

We know that because the bitcoin network is set up in such a way that it produces a block of transactions every 10 minutes. This exact amount of time has been chosen because it offers a good balance between network security and the need to motivate the miners. If it took more time, miners would have an even smaller chance of getting the reward. But if it took less time and less energy to solve the cryptographic puzzle, the network would be more susceptible to 51% attacks.

The evolution of bitcoin mining

There are more and more miners with cutting-edge equipment that can do some very intensive computational work. Today, most of them work with specialized mining appliances, usually ASIC chips, which are much more powerful than mining hardware used 10 years ago. That’s why every two weeks, the amount of energy needed to solve the cryptographic problem gets recalibrated so that the average solving time for the whole network stays around 10 minutes.

In addition, the prize for miners gets halved every few years. These systems protect the bitcoin from losing value as a currency due to inflation. On the contrary, the fact that fewer and fewer bitcoins get produced will slow down the supply and that will naturally let the growing demand drive the price up.

Does bitcoin mining pay off in 2022?

From everything we just said, it seems that things are getting worse and worse for miners. And it’s kind of true as it’s much more expensive to mine bitcoin today than a few years ago. On the other hand, bitcoin is also much more valuable on the market.

Currently, the reward you get for winning Bitcoin’s little cryptographic competition and creating a block is 6.25 bitcoins. This is quite a prize, currently worth around $250,000 (in November 2021 it was more than $400,000). But have in mind just how difficult it is to earn this money.

Only one node in the whole world gets rewarded every 10 minutes. It’s estimated that there are currently around 1 million miners in the world. Some of them are very rich and some of them own entire mining farms with the most expensive and powerful possible equipment, which makes them much more likely to win the race. When you add in thousands of dollars you should invest even in the cheapest mining devices and huge electricity bills, mining may not seem so attractive.

This is why miners often come together to start mining pools, where they join their processing power. This turned out to be a more viable strategy for many as it increases the miners’ chances to validate the block first. After that, they split the hefty reward with other contributors based on the amount of computational resources that each miner provided.

Final remarks

For anyone planning to enter the cryptocurrency field in one way or another, it’s very important to know the basics of how bitcoin functions. Of course, there’s less pressure if you only plan to use their network to send and receive payments. But even then, it’s good to have some working knowledge of the bitcoin blockchain to avoid some of the most common scams in the crypto world.

All this especially goes for everyone intending to go into mining or trading cryptocurrency. The future price of bitcoin or any other cryptocurrency depends at least partly on how good their technology is, how much potential it has, and what else it’s used for. If you wish to dive deep into cryptocurrencies, this article should only be a starting point in your journey and something to build your knowledge on in the future.

FAQ

What is the concept of cryptocurrency?

Cryptocurrencies are digital currencies that operate on blockchain technology. By design, they don’t depend on central servers installed in banks. Transactions are processed by a large number of nodes around the world that execute strict rules and protocols pre-defined by the network. In other words, the concept of cryptocurrency uses the advantages of digital technology to provide a secure, decentralized way to transfer money and trade currencies.

How to buy bitcoin?

This is as simple as it gets. You just download a crypto exchange app to your phone or any other device. You set up an account and connect a payment option. Then you simply buy bitcoin for fiat money just like you’d do with any other non-digital currency. After that, you can hold it or trade it for some altcoins.

What is bitcoin mining?

Bitcoin mining is basically the process of creating new bitcoins. New bitcoins are awarded to “miners” – people who use their computational resources to process and validate transactions on the network. The fact that the verification process is run by a large number of individual nodes makes the need for a central authority such as a bank obsolete.

What is the future and impact of digital currency?

We don’t really know for now. With new applications of blockchain, such as NFTs, metaverse, and crypto games, it seems like we’re leaning towards creating a comprehensive digital environment run and dominated by blockchain technologies. If this happens, we can expect at least the most widely used cryptocurrencies to gain value over a long period of time. However, all this will largely depend on the way that governments and businesses around the world decide to treat it in the following years.