The world of cryptocurrency is growing bigger every day. Being a free, decentralized network where virtually anyone can trade, it’s attracting more and more newcomers to enter the crypto market, learn about it, and try to make some money.

The initial skepticism seems to be overcome with the first big surge in bitcoin price in 2017 and the fact that bitcoin survived a subsequent 45% fall in value. The cryptocurrency market is still volatile, but has proved to be resilient enough to attract more and more new investors.

It’s very valuable to have your stakes in a rapidly developing industry of the future. Making smart investments in the field of cryptocurrencies can bring you both short-term and long-term profit, but you’ll have to be dedicated and ready to learn and make some mistakes in the process.

Here are some guidelines about how and where to invest in cryptocurrency. We’ll try to analyze some fundamental steps you should take and some basic strategies you can use to maximize the profit.

Cryptocurrency trading

The most common way to enter the crypto world is cryptocurrency trading. Cryptocurrency is traded in a safer, decentralized way, independently of any central bank or other institutions. Thanks to the blockchain technology it’s based on, there are no middlemen and very few security risks.

In any other respect, however, cryptocurrency trading is similar to activities on a regular stock market. You try to buy some currency when it’s cheap and try to sell it when it’s expensive. Of course, this is easier said than done. How do you even start?

Choose the exchange platform

Crypto trading takes place on crypto exchanges. These are apps where you can check the prices, trends, and buy and sell currencies. But first of all, you’ll have to buy some crypto coins from the exchange and you’ll pay for this initial stack of cryptocurrencies with fiat money. You can even keep your coins in the exchange app’s wallet, but it’s generally recommendable to download a specialized wallet app to keep your assets more secure.

Among the most famous crypto exchanges there are platforms such as Binance, Coindesk, Kraken, Gemini, crypto.com, FTX, and many more.

How to choose the best crypto exchange?

When choosing the best exchange platform for your needs, here are a few things to have in mind:

- Liquidity: liquidity is huge for crypto traders, especially for those looking for quick, short-term profit. If an exchange doesn’t have enough reserves of a certain cryptocurrency or slows down your transactions for any other reason, this can be very harmful to the traders. It’s a highly unstable market and getting the best possible price can be a matter of minutes. That’s why you can’t go for exchanges with low liquidity that need too much time to obtain the coin you need.

- Fees: providing crypto exchange services is not cheap. It requires extensive IT infrastructure and large amounts of computing power, so traders normally pay a fraction of what they buy or sell to the exchange. Always check how big this fraction is at different platforms, as the difference can be substantial.

- Supported cryptocurrencies: there are over 10,000 different cryptocurrencies in the world. For now. Some trading strategies involve handling a large number of different coins, so you’ll want to check which ones are supported on a certain exchange.

- Reputation and years active: although blockchain is a rather secure technology, it still leaves room for scams. Especially given the anonymity and the lack of central authority usually associated with the crypto world. So look for user ratings, reviews, and other indicators of the platform’s credibility. Oftentimes, the fact that the exchange has been active for a few years is sufficient proof that it should be relatively safe.

Conduct research on cryptocurrencies

Next up, you need to get well-informed in order to make smart decisions. Of course, it’s a long and painstaking process, but here’s how to get started.

Factors that affect the price of cryptocurrency

First of all, have in mind the factors that drive the price of a cryptocurrency. In the heart of it, there’s the law of supply and demand, just like when trading basically any other asset. With fewer coins in circulation and more people interested to buy, the price is always likely to go up.

But with cryptocurrencies as well as with any other speculative market, the media hype and the opinion of the general public can be a big factor. That’s why it’s crucial to follow the news from the market, both when it comes to financial reports and technological breakthroughs that could affect predictions of the coin’s future utility and popularity.

How to start researching cryptocurrency?

You’ll need to conduct both technical and fundamental analysis in order to get the best results. There are numerous circumstantial factors that affect the price of a cryptocurrency. For instance, the attitude of the world’s most powerful governments and institutions, as well as their potential readiness to accept a certain cryptocurrency as a valid payment method can influence its value significantly.

Finally, always try to find out who stands behind a certain coin and a certain project. If they have a history of successful blockchain business ventures, they could be a good pick again. There are always new coins, new technologies, new faces, new investors, so this research basically never stops and you have to keep learning all the time.

Choose your strategy

Obviously, there’s a wide array of different strategies you can employ while trading. As it’s impossible to present all key strategies in a single blog post, we’ll just briefly introduce you to some of the most common ones.

1. Day trading: some crypto traders choose to go for quick rewards from trading by taking advantage of dramatic short-term fluctuations. On the one hand, this makes sense as the crypto market is highly volatile, so these fluctuations are quite common. However, predicting them is a very tricky task, so risking large sums of crypto money virtually every day can become quite stressful.

2. Buy and hold: sometimes it makes more sense to analyze trends over long periods and think well ahead of time in order to generate profit. It’s a somewhat safer, but definitely slower option. Also, make sure that the coin of your choice can pass the test of time and bring you long-term benefits.

The safest option is usually going for the well-established and widely used cryptocurrencies such as BTC or ETH as they seem to be the most stable ones. Finding an anonymous altcoin that will survive the years to come and gain significant value can indeed help you make a lot of money, but you need to be aware that there’s a very low chance it could happen.

3. Dollar-cost averaging: this is a type of investment where you decide to distribute your investments over a certain period of time. For instance, instead of investing $1200 at once on a certain asset, you invest $100 once a month for a year. This way you avoid splashing large sums of money on a coin right before it drops significantly. You can minimize potential losses, but also lower potential gains.

All in all, the strategy you’ll choose depends on your ambitions and needs. Make sure you get all the relevant info about the possible benefits and consequences of each viable strategy.

Crypto mining

What is crypto mining?

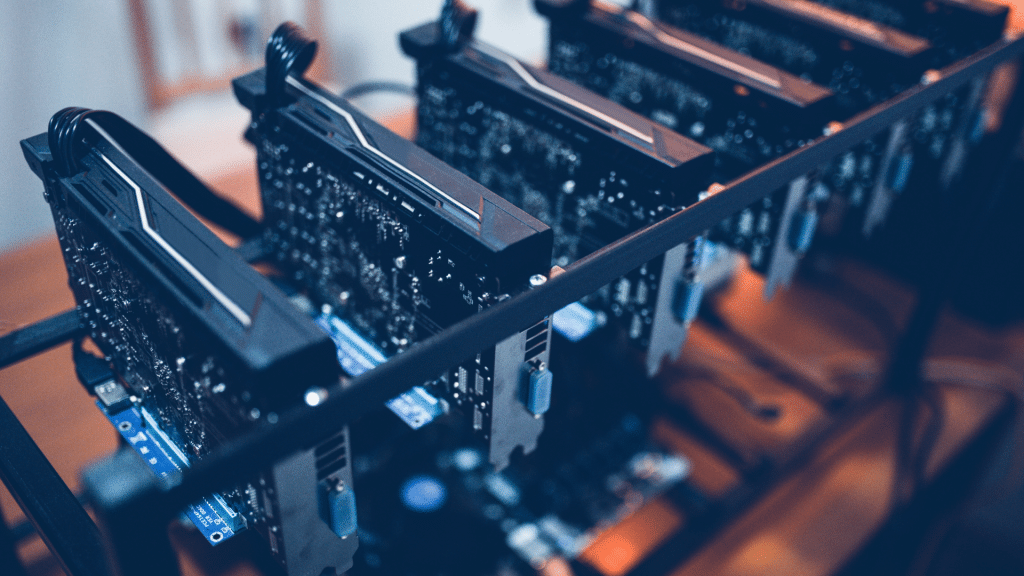

Apart from trading, there’s another, somewhat more demanding way to invest in cryptocurrency. While traders basically need a phone and an app to trade, miners need expensive hardware and at least some working knowledge of blockchain technology.

In short, “mining” a cryptocurrency means basically lending your processing power to a blockchain network and getting crypto coins in return. This processing power is used in solving problems and verifying transactions and also acts as a kind of safeguard against potential cyber-attacks.

The blockchain is decentralized and anyone who gained control over 51% of the devices in the network could potentially hack it and manipulate the verification process. However, the amount of energy needed to do this is so huge that it’s virtually impossible for one person or a small group to threaten the security of the blockchain.

How can you make money in crypto mining?

Well, you need to install the hardware capable of mining crypto coins (lately, it’s mostly ASIC chips), connect it to the network and start validating transactions and earning cryptocurrency.

How much money can you make in crypto mining?

This depends on a number of circumstances and factors. Firstly, the amount of computing power you own is a huge factor. The more you have it, the bigger the chances you’ll get more money. Furthermore, it depends on the price of the currency you’re mining, which can change overnight.

Another factor is mining difficulty, which gets increased all the time. Blockchain networks are purposefully making mining more difficult and lowering the rewards to keep the mining rate unchanged. There are also more and more miners on blockchains, making the competition even fiercer and the chances to earn some real money even lower. Finally, there are hardware equipment expenses you need to count in as well as high electricity bills.

This is one of the reasons why people join mining pools: to try to join their collective computing power and increase their chances for a reward. For instance, the biggest BTC pool, FoundryUSA amounts to more than 20% of all computing power on the network.

Crypto staking

What is crypto staking?

Cryptocurrency mining works on blockchains that use a Proof-of-Work system (PoW), which consumes a whole lot of energy. However, there’s a more efficient, Proof-of-Stake system (PoS) that uses the number of coins you own as a safeguard instead of computing power.

This means that you’ll need to earn, and then temporarily lock a bunch of coins of a currency that you’re mining. These coins serve as a sort of collateral and a guarantee that you won’t try to trick the network. And because of the specific way blockchains work, one would have to own 51% of all coins in order to be able to hack the system. For any established cryptocurrency, this is more-less impossible.

What’s in it for you?

The staking reward system is somewhat similar to mining, but with a slight twist that makes it more energy-efficient. Nodes don’t compete for a reward by solving problems, but are instead chosen randomly by the network, based on the size of their stake. When a node gets chosen to validate the blocks, it gets a prize in coins.

The trouble with staking is that for most networks you need a lot of coins to be able to stake. In the newly emerging Ethereum PoS network, you need a minimum of 32 ETH, worth $80,000 at this moment. However, some blockchains like Solana require a really small amount of coins but will charge you high voting fees if you wish to be involved in any decision-making about the network.

Final thoughts

At last, it’s important to mention that we’ve seen only the most common ways to invest in cryptocurrency. For instance, there are multiple forms of crypto lending that can help you make decent money in the long run. There are also free promotional crypto “giveaways” like airdrops or ICOs you can take advantage of. We’ll talk about these some other time.

Until then, try using the tips for trading, mining, and staking and find out which of these investments suits you best. Best of luck!

FAQs:

How much does it cost to invest in cryptocurrency?

It depends on whether you’d like to trade, mine, or stake.

Trading costs virtually nothing although you’ll naturally need the initial capital to buy the currency (or currencies) of your choice and then start trading them.

Mining costs depend on how big your mining operation is going to be, but they’re generally measured in thousands of dollars. There are some very good profitability calculators around the web that you should use to check how much money each different setting could make for you.

Staking usually demands that you already own a large quantity of coins (often worth as much as tens of thousands of dollars) in order to be able to stake at all. However, there are some blockchains like Solana that offer staking rights to virtually anyone who holds even a very low amount of the SOL coin.

How to safely invest in cryptocurrency?

The best way to be safe is not to invest more than you can lose. There’s probably no truly safe way to make money in crypto without any risks, but this goes for basically any asset, not just crypto assets. Be thorough in your research and don’t fall for anyone promising crazy big money in a short amount of time.

Which cryptocurrency to invest in?

There are countless strategies you can apply so there’s no one currency that’ll surely bring you profit or loss. For beginners and long-term holders, it’s probably best to go for stable and well-established currencies such as BTC or ETH. However, if you want a quick profit, then you should probably take advantage of the instability displayed by some less-known altcoins.

Why invest in cryptocurrency?

Here are a few main reasons why you should think about investing in cryptocurrency:

- It’s a growing market. With new applications of the blockchain we’re seeing lately, it’s probably about to grow even further.

- It’s a technology of the future and probably the payment method of the future. As we approach this “future”, we can expect crypto assets to gain value.

- It’s probably the safest way to do financial transactions

- It’s the most prominent attempt to create a truly decentralized payment system that isn’t controlled by banks and other institutions

- It can be a whole lot of fun!